Title: Up to My Neck! (Literally and Financially)

Man, after riding the tire shovel straight for 9 days, my neck is stuck. It won’t turn.

I don’t even have any debt, so why is this happening…?

I’ve taken plenty of spills in the past, so it’s like a chronic condition now, pretty painful.

A tribute from an Evo owner.

I’m basically a NEET now and can’t do anything for you, so please don’t worry about me.

Thank you.

The Bank of Japan raised its policy interest rate to 0.75%, and the world is making a huge fuss about it. But considering that 80% of people choose variable interest rates, maybe it’s natural. However, historically speaking, we are still in a period of abnormally low interest rates. If you are planning to build a house in Kitami from now on, please look at the numbers calmly.

There are variable and fixed interest rates for mortgages, but my rule is “3 times the variable rate is the appropriate fixed rate.” The current market, with variable at around 0.7% and fixed around 2.1%, is exactly like this. Interest rates do not go down in an inflationary phase.

If you build a house for a total of 35 million yen in Kitami, with 5 million for land and 30 million for the building, this is the crossroads of fate. At a fixed 2.0%, it’s 116,000 yen per month; at a variable 0.7%, it’s 94,000 yen per month. Banks appeal to that 22,000 yen difference, but 90% of Evo Home owners chose fixed. Because the risk of payments skyrocketing in the future is far scarier.

The terminal rate (the end point of interest rate hikes) I predict is 1.5% for the Bank of Japan’s policy rate and 3.5% for the fixed mortgage rate. 3.5% is the “normal interest rate,” and the current 2.0% is just a bargain sale. Even if you try to escape to fixed after variable rates have risen completely, fixed rates will also be far higher at that time, and there will be no exit.

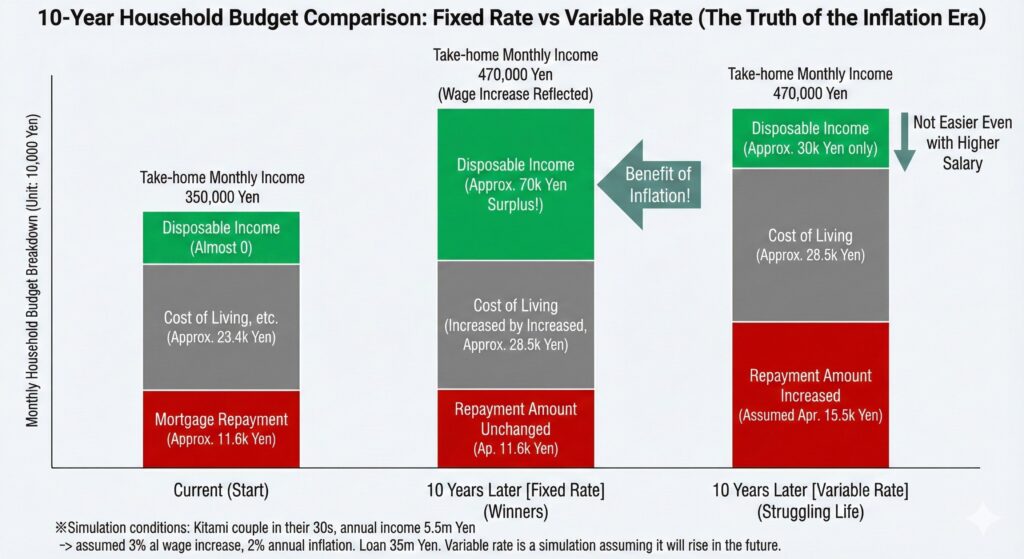

Please look at the table above. This is the truth about “fixed rate” vs. “variable rate” in 10 years.

Look at the middle bar graph. This is the figure of the winners who maintained “the current fixed rate (2.0%).” Assuming a household in Kitami in their 30s with an annual household income of 5.5 million (take-home 350,000), and assuming wages rise by 3% and prices rise by 2% in the future. In 10 years, take-home pay will increase by 120,000 yen, but the cost of living will also increase by 50,000 yen due to high prices. However, with a fixed interest rate, the loan repayment amount remains 116,000 yen. As a result, a margin of 70,000 yen per month is created.

On the other hand, the bar graph on the right. This is the reality if you chose “variable interest rate.” “Eh, the repayment amount is 155,000 yen? It can’t go up that much, right?” Did you think that? Do you think it’s okay because there is a “5-year rule” or “125% rule”?

That is a big mistake. Those rules only “don’t change the monthly payment amount suddenly,” and they do not “exempt interest to the bank.” When inflation progresses and interest rates return from current abnormal values to a “normal 4.0%,” the bank will take exactly 4.0% interest. Even if the monthly payment amount is suppressed by rules, the interest that did not fit in will just continue to be added to the debt underwater as “unpaid interest.”

The red bar on the right side of this graph represents the “actual cost you should pay” that you will bear, including such “hidden debt.”

With variable interest rates, the salary you managed to increase will also be swallowed up by this swollen interest. While people with fixed interest rates float 70,000 yen a month and travel or save, people with variable interest rates will see a hell where “salary should have gone up, but for some reason, debt doesn’t decrease.”

The worry “What if deflation happens and I lose out?” is also unnecessary. Refinancing from “fixed to variable” in a phase where interest rates are falling is easy, but refinancing from “variable to fixed” in a phase where interest rates are rising is difficult. If repayment amounts increase and household finances are squeezed, “credit” will be insufficient, and you won’t even pass the screening.

The reason Evo Home owners can remain indifferent to interest rate news is that they have secured this “safety zone.” Finally, even if I were a financial institution person, I would sell “variable interest rates” where we don’t bear risk and make a profit. It is standard thinking for banks to make customers bear the risk. Understand that, and please walk the long journey of 35 years in a state where “your neck can always turn.”

I’m watching this on TV, and Park Seo-jun’s “Tomorrow Will Surely Come.”

Man… busy watching (lol)